43+ mortgage insurance premiums tax deductible

Taxes Can Be Complex. Web The tax deduction for PMI premiums or Mortgage Insurance Premiums MIP for FHA-backed loans is not part of the tax code but since the financial crisis has.

Thairobbin Multiple Streamsofincome

Whether you qualify depends on both your filing status and.

. Web Not everyone can take advantage of the deduction for qualified mortgage insurance premiums MIP. If you are over 65 or blind youre. Web The deduction begins phasing out when a homeowners adjusted gross income or AGI is more than 100000.

Web A big caveat. Learn more on the IRS. Ad Our Simple Guide Will Help You Understand Common Mortgage Terms.

Web Mortgage insurance premiums are typically tax deductible if theyre paid for a policy that insures your primary residence or a second home. But for loans taken out from. 1 2019 you might be able to deduct 286 on.

In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. This income limit applies to single head of.

If you are claiming itemized deductions you can claim the PMI. Industry experts use this rule of thumb. The PMI tax deduction works for home purchases and for refinances.

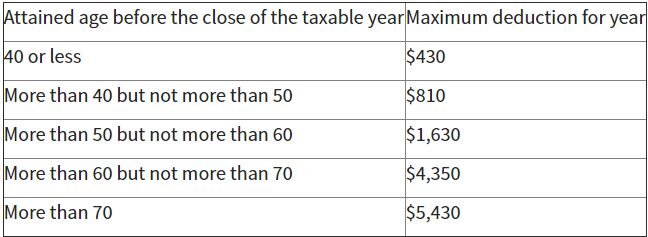

However higher limitations 1 million 500000 if married. Web How much you can deduct depends on your age just as the amount of premium depends on your age. Be aware of the phaseout limits however.

Web The mortgage insurance premium deduction phases out once your adjusted gross income AGI is more than. After 2018 PMI premiums arent tax. Understand The Home Buying Process Better.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. Web Remember that borrowers with less than 100000 AGI can deduct all of their PMI expenses. Remember the deduction is only good through tax year 2020.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web The itemized deduction for mortgage insurance premiums has expired and you can no longer claim the deduction for tax year 2022. Homeowners who are married but filing.

Web Web Private mortgage insurance tax deductions. Web Youll usually have Private Mortgage Insurance PMI if you borrowed an amount worth 80 or more of the total purchase price. Married taxpayers filing separately.

Web Originally private mortgage insurance tax deductions were part of the Tax Relief and Health Care Act of 2006 and applied to PMI policies granted in 2007. So if you paid 2000 in upfront PMI premiums on Jan. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web As of tax year 2021 the tax return youd file in 2022 the amount of insurance premiums youre entitled to deduct begins decreasing by 10 percent per. Mortgage Insurance Tax Deductions. Web Mortgage interest.

The following amounts are deductible provided you paid. It depends on how much youre paying and what your tax bracket is. Web Married taxpayers filing a joint return.

Web The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI. Web Morgan Minutes. Web You must allocate the premiums over the shorter of the stated term of the mortgage or 84 months beginning with the month the insurance was obtained.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Irs Issues Long Term Care Premium Deductibility Limits For 2020 Pierrolaw

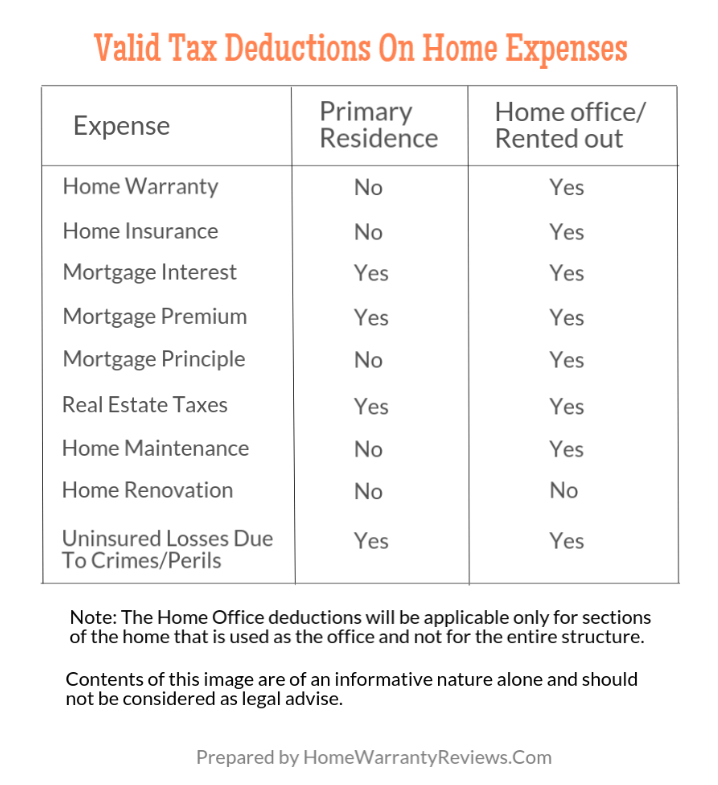

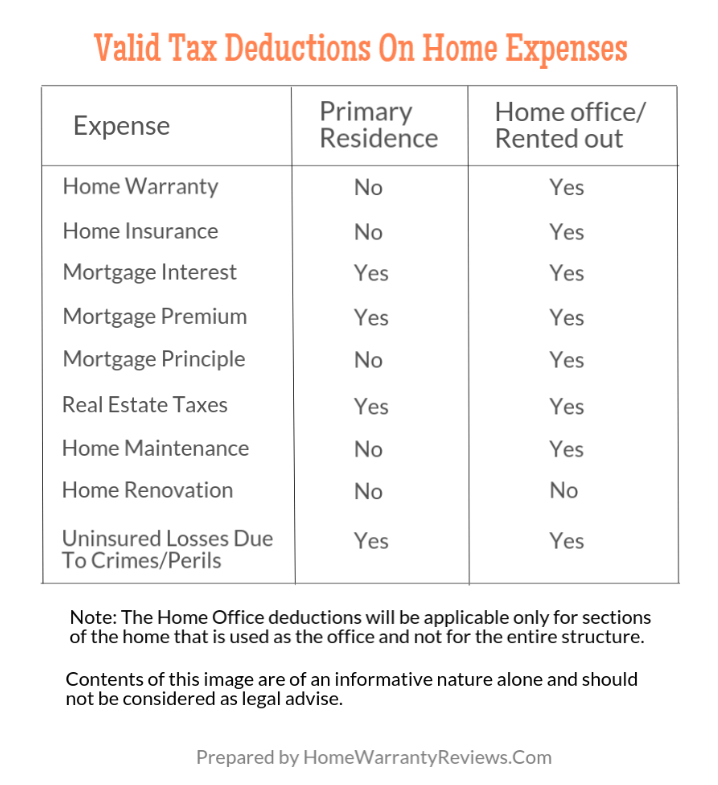

Are Home Warranty Premiums Tax Deductible

Gutting The Mortgage Interest Deduction Tax Policy Center

Business Succession Planning And Exit Strategies For The Closely Held

Tbank Annual Report 2007 Eng By Shareinvestor Thailand Issuu

Join The Signature Family By Signature Real Estate Companies Issuu

Is Mortgage Insurance Tax Deductible Bankrate

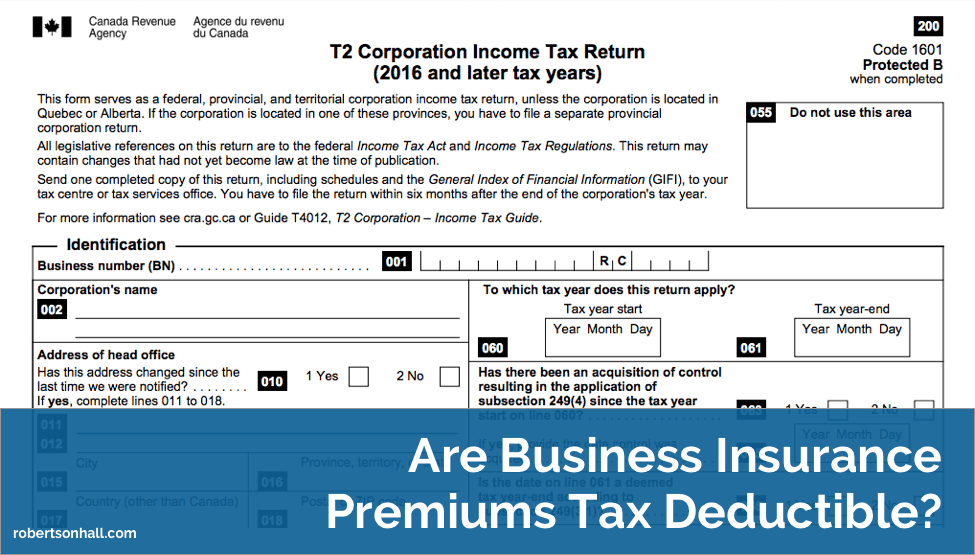

Are Business Insurance Premiums Tax Deductible Robertson Hall Insurance

Courier News Vol 43 Num 11 By Edward Reagan Issuu

Home Related Tax Breaks Delaware Business Times

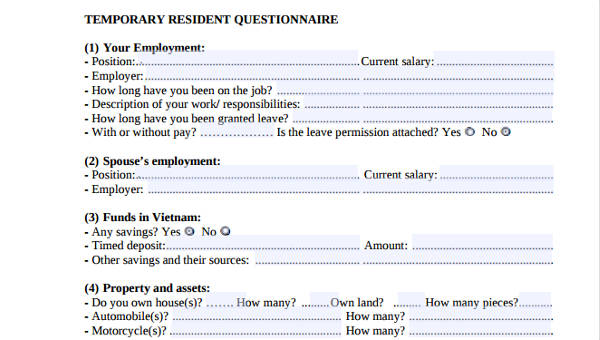

Free 43 Questionnaire Forms In Pdf Ms Word Excel

Learn About The Mortgage Insurance Premium Tax Deduction 2023 Pakth

News Energetic Insurance

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

American Economic Association

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World

Can You Deduct Mortgage Pmi On Your Tax Return Pinewood Consulting Llc